When you think of currency exchange rates, they often seem like distant, impersonal numbers—fluctuating based on a thousand different economic factors. But in reality, these exchange rates are tied to the very pulse of a nation’s economy. For Kenya, the state of the Kenyan Shilling (KES) and its performance against the US Dollar (USD) holds deep implications for its citizens, businesses, and the future of the country.

As of now, the exchange rate sits at 129.89 KES to 1 USD, a slightly better position than when it was previously hovering around 150 KES per dollar. While this shift seems positive on the surface, there’s more to the story. Could this recent stabilization be a sign of better times ahead, or are we simply witnessing a brief pause in a larger economic struggle? To understand this, let’s take a closer look at what’s happening with the Kenyan Shilling, how it compares to the US Dollar, and what the future might hold.

Kenya's Struggle with the Shilling: A History of Weakening

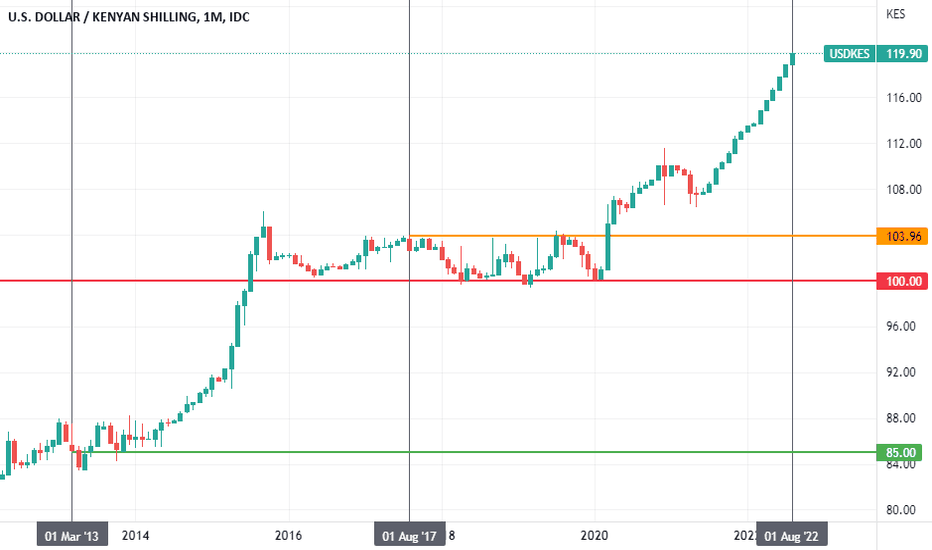

To understand the current position of the Kenyan Shilling, it’s important to appreciate the challenges it has faced in recent years. Like many emerging economies, Kenya has seen its currency weaken against the US Dollar, a trend that has caused considerable concern. The country’s exchange rate has long been driven by a series of factors, from global trade dynamics to domestic economic policies.

At its worst, the Kenyan Shilling dropped below 150 KES to 1 USD, raising questions about Kenya’s economic stability. But why has the Shilling been so weak? To put it simply, Kenya has often found itself in a trade deficit, importing more than it exports. This means more Kenyan Shillings are spent buying foreign goods, placing increasing demand on US Dollars. With limited exports to match that demand, the Shilling weakened, struggling to keep pace.

Moreover, Kenya’s external debt, often denominated in foreign currencies, placed additional strain on the Shilling. As debt payments became more expensive, the Shilling continued to slide. It wasn’t just about numbers on a screen—it was about real-world implications. Rising import costs meant everything from fuel to food became more expensive for the average Kenyan. Inflation spiraled, eroding purchasing power and increasing the cost of living.

The Recent Stabilization: Is It Real or Just a Pause?

Now, with the exchange rate at 129.89 KES per USD, there’s a slight sense of optimism in the air. The shift from above 150 KES to around 130 KES feels like a step in the right direction, but the question remains: Is this a real improvement, or just a temporary blip in a larger trend of depreciation?

Several factors might explain why the Kenyan Shilling has improved slightly. First, Kenya’s export sector has seen some improvement. With key products like tea, coffee, and horticultural goods gaining international demand, Kenya’s foreign currency inflows have been boosted. If this trend continues, the country may have more foreign currency to spare, which could help stabilize the Shilling.

The Central Bank of Kenya (CBK) has also taken proactive steps to manage the currency. Tightening monetary policy and addressing inflation concerns are part of efforts to keep the Shilling from weakening further. Meanwhile, foreign direct investments (FDI) have also increased, especially in sectors like technology and infrastructure, contributing to a stronger Shilling by bringing in more foreign currency.

But despite these positive signs, we must ask: Can Kenya maintain this upward momentum? Or is this brief period of stability simply a temporary reprieve before the Shilling’s inevitable fall back into weaker territory?

The US Dollar: A Measure of Global Power

To understand the complexities of the Kenyan Shilling, we must also consider the US Dollar’s role in the global economy. The US Dollar remains the world’s primary reserve currency, and its strength or weakness can significantly influence the exchange rates of other currencies. If the US Dollar strengthens globally, it often causes weaker currencies, particularly those in emerging markets, to struggle.

The United States, despite its own set of economic challenges, continues to play a dominant role in global trade, finance, and investments. When the US Dollar strengthens, countries like Kenya find themselves in a delicate balance—trying to manage the rising costs of foreign goods while hoping to maintain a competitive edge in export markets. So, even if Kenya’s Shilling shows slight improvement today, the performance of the US Dollar tomorrow could send it back into decline.

This gives rise to an interesting dynamic: on one hand, the Kenyan government and the Central Bank can implement policies to manage the Shilling’s strength, but on the other, global shifts in the US Dollar’s value and global inflationary trends can disrupt even the best-laid plans.

How Does the Shilling Compare Globally?

When you think of the Kenyan Shilling in relation to other currencies, it’s essential to view it within the context of the broader African and global currency landscape. Compared to the US Dollar, the Kenyan Shilling has historically been weaker, but that doesn’t make it unusual for emerging-market currencies.

Consider neighboring countries like Uganda and Tanzania. Uganda’s currency, the Ugandan Shilling (UGX), and Tanzania’s Tanzanian Shilling (TZS) also face similar challenges, with inflation and trade imbalances often weakening their currencies against the Dollar. However, unlike the Kenyan Shilling, which has seen fluctuations from about 85 KES to over 150 KES per USD, some of these currencies have remained relatively more stable in comparison. This means Kenya faces more pronounced external economic pressure, and the Shilling’s movement can be more volatile.

In contrast, stronger economies like South Africa or Nigeria have seen their currencies perform somewhat better, though even the South African Rand (ZAR) faces periodic devaluations due to similar global forces at play. All of this speaks to the vulnerability of emerging-market currencies, which are particularly sensitive to global economic shifts.

What’s Next for the Kenyan Shilling?

The future of the Kenyan Shilling is uncertain, and many factors will determine whether it continues to stabilize or heads back toward depreciation. Key to this will be the country’s ability to address its long-standing trade deficit, improve its export performance, and manage its foreign debt levels. Without diversification into other sectors beyond agriculture, Kenya will continue to rely on the same products, making it susceptible to global price fluctuations and supply chain disruptions.

Inflationary pressures are also a looming concern. If local prices rise too quickly, the value of the Shilling will continue to erode. However, if the government can manage inflation and foster a conducive environment for local manufacturing and increased exports, there’s hope that the Shilling could maintain its current trajectory.

Additionally, the global economic environment, including the strength of the US Dollar and global inflationary pressures, will play a significant role. Kenya’s efforts to attract more foreign direct investment and improve infrastructure are necessary for stabilizing the Shilling in the long run.

Conclusion: A Fragile Balance of Hope and Reality

The recent improvement in the Kenyan Shilling, currently at 129.89 KES to 1 USD, is a positive sign, but it’s too early to declare that the Shilling is out of the woods. While Kenya has made strides, the underlying economic challenges remain significant, and external factors like the performance of the US Dollar will continue to exert pressure.

In the short term, Kenya’s economic policies may stabilize the currency, but long-term solutions will depend on a balanced mix of export growth, debt management, and inflation control. For now, the future of the Shilling remains a balancing act—between hope for continued stability and the ever-present risk of external economic pressures pulling the currency in the opposite direction.

Ultimately, the Kenyan Shilling’s story is not just about numbers—it’s about real lives, livelihoods, and the broader trajectory of an economy navigating an increasingly globalized world. Whether the future holds brighter prospects or further challenges, it’s clear that Kenya’s economic journey is one of resilience and adaptation.

Comments

Edit Comment

×